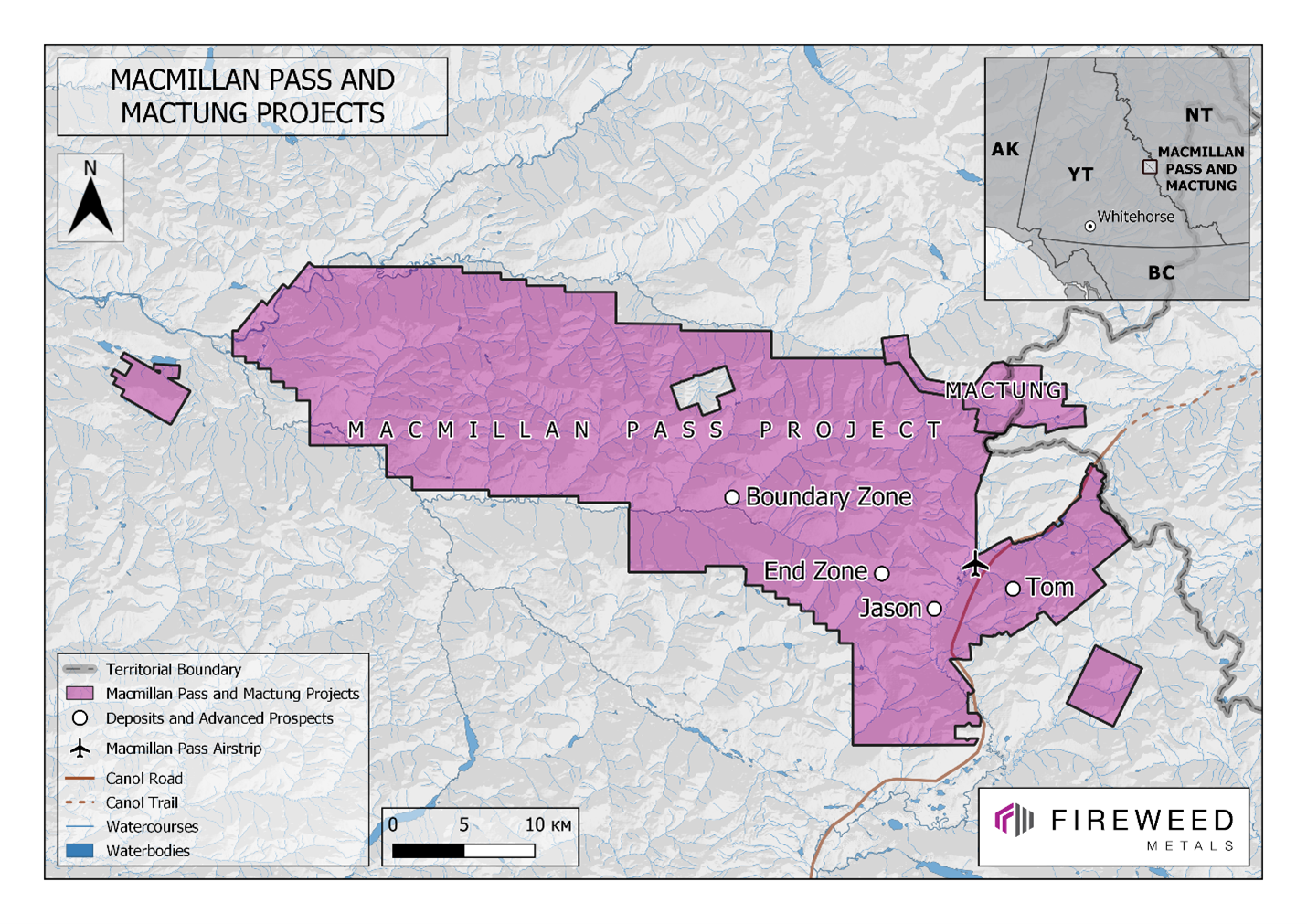

Vancouver, British Columbia: FIREWEED METALS CORP. (“Fireweed” or the “Company”) (TSXV: FWZ; OTCQB: FWEDF, formerly Fireweed Zinc Ltd.) is pleased to announce the final set of results from the 2022 drill program at Tom, Macmillan Pass, Yukon, Canada (Map 1), stated as estimated true widths. All assay results from the 2022 program have now been released.

Highlights

- Multiple wide and high-grade intersections at the Tom deposit.

- Hole TS22-009 intersected a true width of 40.6 m at 15.2% zinc, 14.6% lead, and 181.6 g/t silver, including 9 m of 20.7% zinc, 22.4% lead, and 280.0 g/t silver.

- Hole TS22-001 intersected a true width of 26.9 m of 9.3% zinc, 5.4% lead, and 61.5 g/t silver, including 8 m of 11.4% zinc, 8.9% lead, and 114.9 g/t silver.

- Hole TS22-002 intersected a true width of 9 m of 10.7% zinc, 5.0% lead, and 98.8 g/t silver, including 3.3 m of 18.9% zinc, 14.2% lead, and 324.0 g/t silver.

- Many of the 2022 drill holes have demonstrated significantly better grades and/or wider intersections than the current Mineral Resource block model at the same location.

CEO Statement

Brandon Macdonald, CEO, stated “We are very pleased to close out the reporting of the 2022 results with some phenomenal grades from our Tom deposit. The holes are infill, yet the grades in most of these holes are significantly higher than what has been estimated in our current Mineral Resource for those intersections. We have hit extremely high zinc, lead, and silver grades in intersections of massive sulphides in the feeder zone that are better than anything that we have seen before at Tom West. We see great potential for growth of the Tom resource.”

Tom Drilling Results

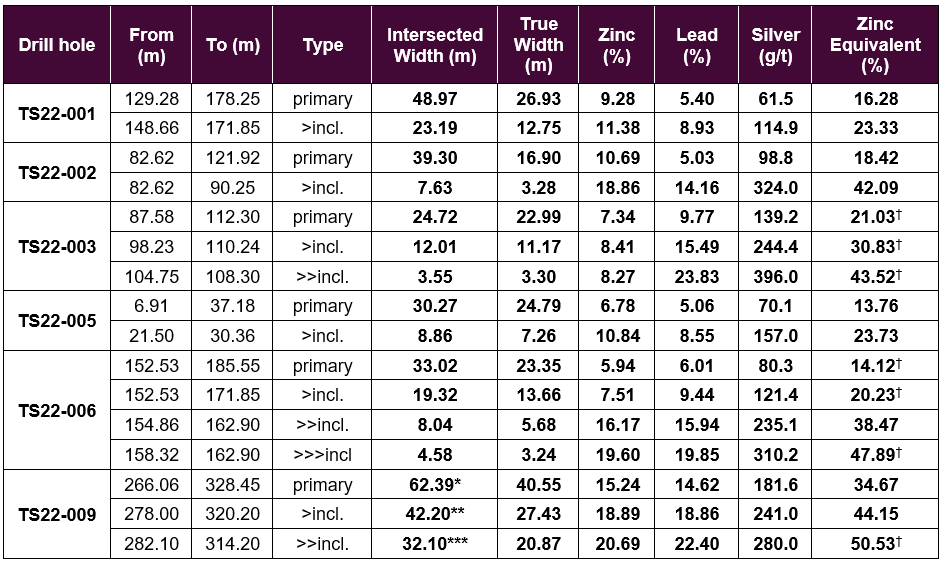

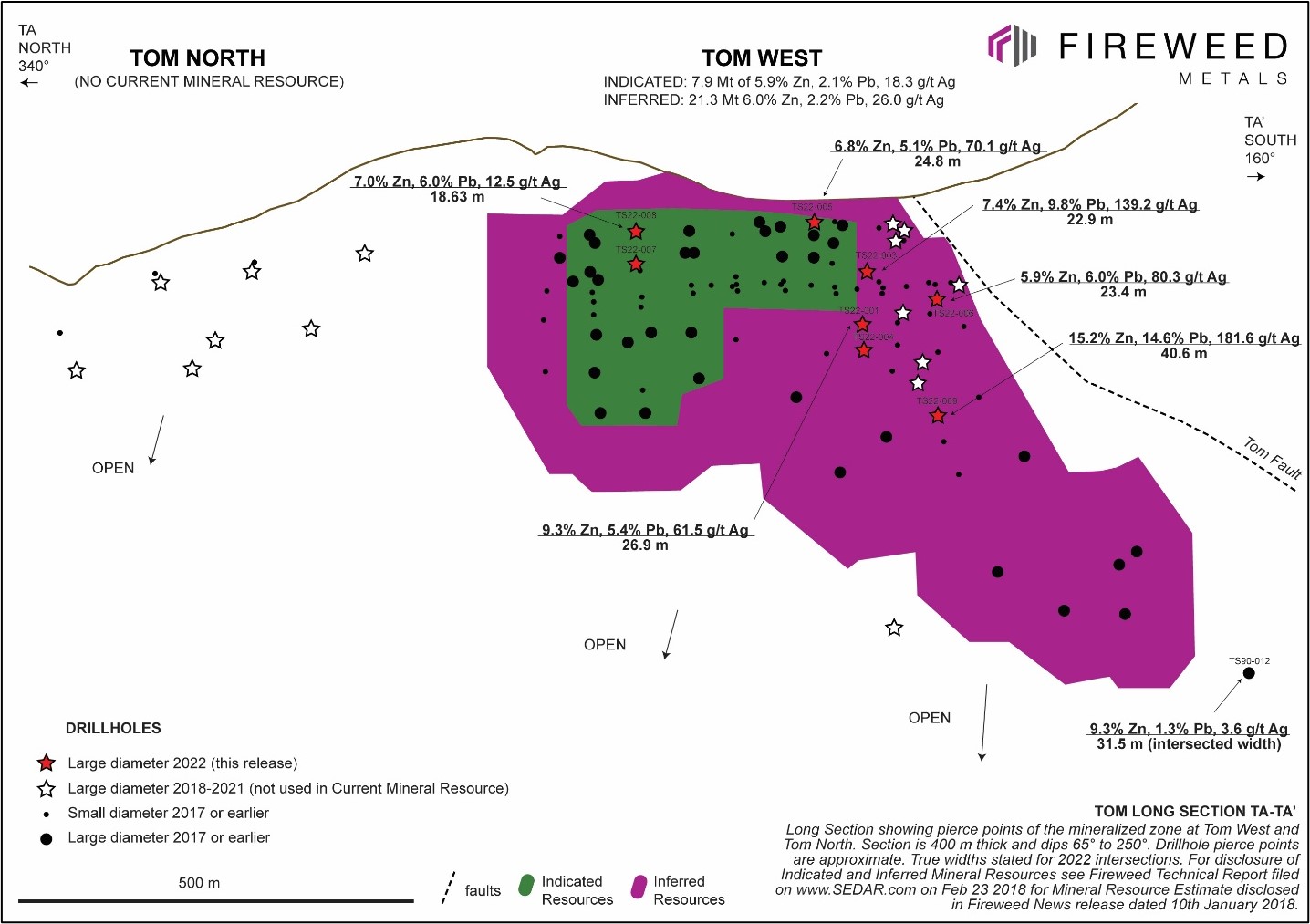

The drill results shown in Table 1 are the highlights from the Tom zinc-lead-silver deposit (Maps 1 and 2) drill holes described in this news release. Table 2 shows the full Tom deposit 2022 drill results.

Table 1: Tom deposit 2022 Drill Results Highlights

†: lead is the single largest value contributor to the zinc equivalent calculation in this intersection; *67% recovery; **59% recovery; ***58% recovery. Numbers in the text may differ slightly from numbers in the table due to rounding. True widths in this news release are estimates based on currently available information. See note below for zinc equivalent grade calculation. Unless otherwise noted, zinc is the single largest value contributor to metal value in the zinc equivalent grade calculation for each intersection in this table.

The Tom zinc-lead-silver deposit

Fireweed’s 100% owned, road-accessible Tom and Jason deposits are some of the world’s largest undeveloped zinc deposits* and host combined current Mineral Resources1 of: 11.21 Mt Indicated Resource at 6.59% zinc, 2.48% lead, and 21.33 g/t silver; and 39.47 Mt Inferred Resource at 5.84% zinc, 3.14% lead, and 38.15 g/t silver. The Tom deposit is subdivided into three distinct zones that have current Mineral Resources: Tom West (Main), Tom East, and Tom Southeast (Map 2). Tom North was drilled by Fireweed in 2019, forms a mineralized zone with no currently defined Mineral Resources, and is located at surface adjacent to Tom West (Map 2, Long Section TA-TA’). Fireweed’s current Mineral Resource was published in early 2018, based on 2017 and earlier drilling only. Boundary Zone, Fireweed’s new discovery and the focus of 2022 drill results reported to date, is located 21 kilometres WNW from the Tom deposit.

Tom West

Eight infill holes were drilled at Tom West, focusing mostly on the mineralization around the feeder zone within part of Fireweed’s current Mineral Resource. This area is the highest-grade part of the Tom West Mineral Resource and is supported largely by historic drill holes with small diameter core and poor core recovery. Six out of the eight holes drilled at Tom West in 2022 returned grades that are significantly higher than what had been estimated in the current Mineral Resource model for those parts of the deposit. These differences in grade are likely due to better recovery of the higher-grade sections within each intersection in the new, larger diameter drilling compared to the small diameter core drilled in early years which often had poor recoveries. All infill holes demonstrated excellent continuity of mineralization and good grades (see Tables 1 and 2, Long Section TA-TA’).

Hole TS22-009 returned spectacularly high grades within an interval of massive sulphide over 40.6 m true width of 15.2% zinc, 14.6% lead, and 181.6 g/t silver, including 20.9 m of 20.7% zinc, 22.4% lead, and 280.0 g/t silver (Table 1).

Hole TS22-001 intersected a true width of 26.9 m of 9.3% zinc, 5.4% lead, and 61.5 g/t silver including 12.8 m of 11.4% zinc, 8.9% lead, and 114.9 g/t silver. The intersection comprised laminated sphalerite-galena-barite-pyrite with minor interbedded cherty black mudstones typical of the stratiform mineralization at Tom West.

Tom West remains open to expansion in multiple directions and there is additional potential to improve upon historic poor-recovery drilling by completing additional infill drill holes that may yield higher grades of zinc, lead, and silver with improved recovery (Long Section TA-TA’).

Tom East

Hole TS22-002 was drilled as an infill hole at Tom East, not only confirming the high grades previously known at Tom East, but providing an intersection with grades higher than currently modeled in an equivalent intersection within that part of the current Tom East Mineral Resource model. The estimated true width at the intersection is 16.9 m that returned 10.7% zinc, 5.0% lead, and 98.8 g/t silver including 3.3 m of 18.9% zinc, 14.2% lead, and 324.0 g/t silver, highlighting some of the very high grades present at Tom East.

Qualified Person Statement

Technical information in this news release has been approved by Fireweed Metals Chief Geologist, Jack Milton, Ph.D., P.Geo. (BC), a ‘Qualified Person’ as defined under Canadian National Instrument 43-101.

About Fireweed Metals Corp. (TSXV: FWZ; OTCQB: FWEDF; FSE:20F): Fireweed Metals is a public mineral exploration company on the leading edge of Critical Minerals project development. Fireweed is well-funded, with a current cash position of approximately C$38,000,000 and is well-positioned to carry out a large 2023 exploration program. The Company has three projects located in Canada:

- Macmillan Pass Zinc-Lead-Silver Project: Fireweed owns 100% of the district-scale 940 km2 Macmillan Pass project in Yukon, Canada, which is host to one of the largest undeveloped zinc resources in the world* where the Tom and Jason zinc-lead-silver deposits have current Mineral Resources1 (21 Mt Indicated Resource at 6.59% zinc, 2.48% lead, and 21.33 g/t silver; and 39.47 Mt Inferred Resource at 5.84% zinc, 3.14% lead, and 38.15 g/t silver) and a Preliminary Economic Assessment2 (PEA). In addition, Boundary Main, Boundary West, Tom North and End Zone have significant zinc-lead-silver mineralization drilled but not yet classified as mineral resources. The project also includes large blocks of adjacent claims with known showings and significant upside exploration potential.

- Mactung Tungsten Project: The Company recently signed a definitive Asset Purchase Agreement and acquired 100% interest in the 37.6 km2 Mactung Tungsten Project located adjacent to the Macmillan Pass Project. Mactung contains historic resources that make it one of the largest and highest-grade undeveloped resources in the world of the Critical Mineral tungsten*. Located in Canada, it is one of the rare large tungsten resources outside of China. An updated mineral resource is planned for Q2 2023, and re-sampling of historic drill core is continuing and will include assays for previously unreported by-product metals, such as gold, copper, and bismuth, in addition to tungsten.

- Gayna River Zinc-Lead-Gallium-Germanium Project: Fireweed has 100% of the 128.75 km2 Gayna River project located 180 kilometres north of the Macmillan Pass project. It is host to extensive mineralization including Critical Minerals zinc, gallium and germanium as well as lead and silver, outlined by 28,000 metres of historic drilling and significant upside potential. The results from the 2022 field program of geochemical sampling, airborne LiDAR topographic surveying and ground geophysics are now being interpreted towards defining drill targets.

In Canada, Fireweed (TSXV: FWZ) trades on the TSX Venture Exchange. In the USA, Fireweed (OTCQB: FWEDF) trades on the OTCQB Venture Market for early stage and developing U.S. and international companies and is DTC eligible for enhanced electronic clearing and settlement. Investors can find Real-Time quotes and market information for the Company on www.otcmarkets.com. In Europe, Fireweed (FSE: 20F) trades on the Frankfurt Stock Exchange.

Additional information about Fireweed and its projects can be found on the Company’s website at FireweedMetals.com and at www.sedar.com.

ON BEHALF OF FIREWEED METALS CORP.

“Brandon Macdonald”

CEO & Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Data Verification

The diamond drill core logging and sampling program was carried out under a rigorous quality assurance / quality control program using industry best practices. Drill intersections in this release are HQ3 (split tube) size core (61.1 mm / 2.406-inch diameter) or NQ2 size core (50.5 mm / 1.99-inch diameter) with recoveries typically above 85% unless otherwise noted in the results tables. After drilling, core was cleaned, scanned with a core scanning machine, logged for geology, structure, and geotechnical characteristics, then marked for sampling and photographed on site. The cores for analyses were marked for sampling based on geological intervals with individual samples 2 m or less in length. Drill core was cut lengthwise in half with a core saw; half-core was sent for assays reported in this news release, and the other half is stored on site for reference. Bulk density was determined on site for the entire length of each sample assayed by measurement of mass in air and mass in water. Sample duplicate bulk density determinations and in-house bulk density standard determinations were each made at a rate of 5%. Since 2017, four in-house bulk density standards (mineralized drill core from the Tom deposit that span a range of densities) have been used and show an acceptable long-term precision. Certified standard masses are used to calibrate the scale balance used for bulk density determinations.

A total of 5% assay standards or blanks and 5% core duplicates are included in the sample stream as a quality control measure and are reviewed after analyses are received. Standards and blanks in 2022 drill results to date have been approved as acceptable. Duplicate data add to the long-term estimates of precision for assay data on the project and precision for drill results reported is deemed to be within acceptable levels. Samples were sent to the Bureau Veritas preparation laboratory in Whitehorse, Yukon, where the samples were crushed and a 500 g split was sent to the Bureau Veritas laboratory in Vancouver, British Columbia to be pulverized to 85% passing 200 mesh size pulps. Clean crush material was passed through the crusher and clean silica was pulverized between each sample. The pulps were analyzed by 1:1:1 Aqua Regia digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-ES/ICP-MS) multi-element analyses (BV Code AQ270). All samples were also analyzed for multiple elements by lithium borate fusion and X-ray fluorescence analysis (XRF) finish (BV Code LF725). Over-limit Pb (>25.0%) and Zn (>24.0%) were analyzed by lithium borate fusion with XRF finish (BV Code LF726). Silver is reported in this news release by method AQ270, and zinc and lead are reported by LF725 or LF726. Bureau Veritas (Vancouver) is an independent, international ISO/IEC 17025:2005 accredited laboratory.

Results in this news release are length and bulk-density weighted averages as would be used in a Mineral Resource estimate. Readers are cautioned that in Fireweed’s news releases prior to 2020, only length weighted assay averages were reported which may result in slightly lower (under-reported) average values. Length and bulk-density weighted averages have been reported as these most accurately represent the average metal-content of the intersections.

True widths are estimated by measuring perpendicular to strike within the short axis of an approximately tabular shaped wireframe that has been constructed in 3D around the mineralized zone at Tom West based on assay results, geological logging, and bedding measurements from oriented core. The mineralization at the Tom deposit is mostly stratiform (oriented parallel to bedding), therefore the true width, or thickness, of the zone is estimated perpendicular to both the strike and dip direction of bedding.

Zinc Equivalent Calculation

The use of zinc equivalent (ZnEq.) grades in this news release follows the calculation described in Fireweed 2018 Technical Reports1,2, and detailed below:

ZnEq. = (x + y + z + a)/16.16

where x = 16.16*zinc(%); y = 16.08*lead(%); z = (0.05853*silver(g/t))-(0.6146*zinc(%)); and a = (0.447*silver(g/t))-(0.3607*lead(%)). Terms z and a are only included in the calculation of ZnEq. when positive. This ZnEq. calculation assumes metal prices of US$1.17/lb zinc, US$0.99/lb lead, and US$16.95/oz silver. Metal recovery assumptions were: 79% for zinc, 82% for lead, and 85% for silver (whereby 12% would be recovered from a zinc concentrate and 73% would be recovered from a lead concentrate). The ZnEq. calculation includes estimated factors for: metallurgical recoveries, assumed metal prices, and smelter terms including payable factors, treatment charges, and refining charges. The calculation assumes an exchange rate of US$1 = C$1.24.

Cautionary Statements

Forward Looking Statements

This news release contains “forward-looking” statements and information (“forward-looking statements”). All statements, other than statements of historical facts, included herein, including, without limitation, statements relating to interpretation of drill results, future work plans, the use of funds, and the potential of the Company’s projects, are forward looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements are based on the beliefs of Company management, as well as assumptions made by and information currently available to Company management and reflect the beliefs, opinions, and projections on the date the statements are made. Forward-looking statements involve various risks and uncertainties and accordingly, readers are advised not to place undue reliance on forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include but are not limited to, exploration and development risks, unanticipated reclamation expenses, expenditure and financing requirements, general economic conditions, changes in financial markets, the ability to properly and efficiently staff the Company’s operations, the sufficiency of working capital and funding for continued operations, title matters, First Nations relations, operating hazards, political and economic factors, competitive factors, metal prices, relationships with vendors and strategic partners, governmental regulations and oversight, permitting, seasonality and weather, technological change, industry practices, uncertainties involved in the interpretation of drilling results and laboratory tests, and one-time events. The Company assumes no obligation to update forward‐looking statements or beliefs, opinions, projections or other factors, except as required by law.

Investors are cautioned that the drill intersections that are compared to the current Mineral Resources are not subject to any grade capping, and that grades in mineral resource blocks were calculated based on interpolation between assay composites that have capped grades. In the current Mineral Resource at Tom West zinc was capped at 25%, lead was capped at 25%, and silver was capped at 600 g/t; and at Tom East zinc was capped at 30%, lead capped at 50%, and silver at 600 g/t, as described in Fireweed Technical Reports1,2. Grades in new holes were compared to a length and bulk density weighted calculated grade derived from a stack of blocks from the Current Mineral Resource block model perpendicular to the XY plane of the block model spanning the full thickness of the mineralized zone, located through the mid-point of the reported new intersection.

Footnotes and References

* References to relative size and grade of the Mactung historic resources and Macmillan Pass resources in comparison to other tungsten and zinc deposits elsewhere in the world, respectively, are based on review of the Standard & Poor’s Global Market Intelligence Capital IQ database.

1: Fireweed Technical Report titled “NI 43-101 Technical Report on the Macmillan Pass Zinc-Lead-Silver Project, Watson Lake and Mayo Mining Districts Yukon Territory, Canada” filed on www.SEDAR.com on Feb 23, 2018, and Fireweed News Release dated January 10th 2018.

2: Fireweed Technical Report titled “NI 43-101 Technical Report Macmillan Pass Project Yukon Territory Canada” filed on www.SEDAR.com on July 9th 2018, and Fireweed News Release dated May 23rd, 2018. This Preliminary Economic Analysis includes an economic analysis of mineral resources that is preliminary in nature and does not include any mineral reserves. It is equally emphasized that the mineral resources disclosed within this Technical Report are not mineral reserves and do not have demonstrated economic viability.

Contact:

Brandon Macdonald

Phone: (604) 646-8361

Email: info@fireweedmetals.com

Map 1: Macmillan Pass Project and Mactung Project locations.

Map 2: Tom drilling map with drill holes in this release labeled. For green section line, see Long Section TA-TA’ below.

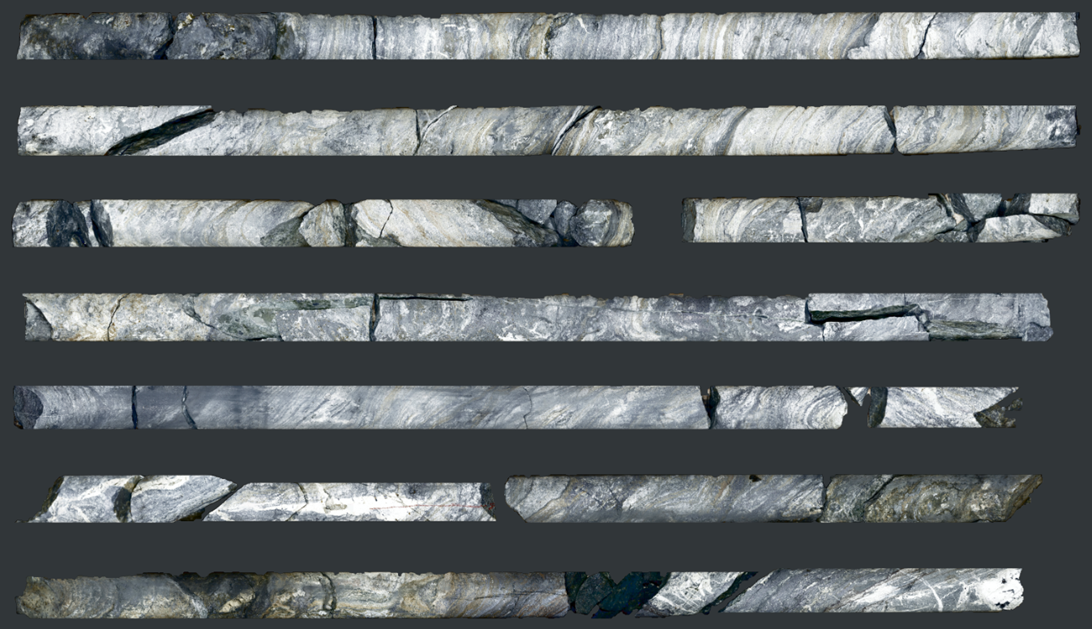

Image 1: HQ3 Core from Tom West in TS22-003, 101.0 m to 108.6 m, including an intersection 104.75-108.30 m that graded 8.3% zinc, 23.8% lead, and 396.0 g/t silver within laminated galena-sphalerite-barite (Tables 1 and 2). Image is a high resolution photomosaic from core scanning with core boxes and blocks filtered out.

Long Section TA-TA’: Overview of Tom West and Tom North with 2022 Tom West drilling results. See Map 2 for section line.

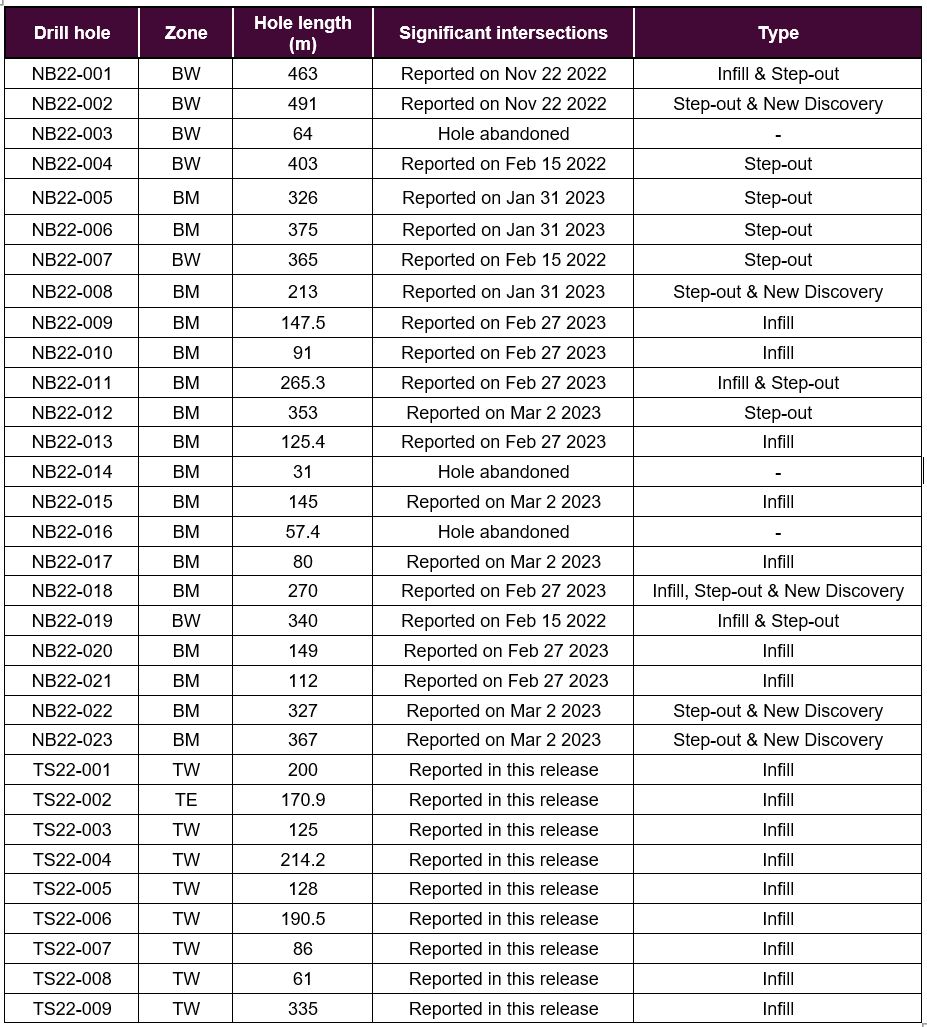

Table 2: Tom 2022 Full Table of Drill Results for All Holes in this News Release.

†: lead is the single largest value contributor to the zinc equivalent calculation in this intersection. *67% recovery; **59% recovery; ***58% recovery. Numbers in the text may differ slightly from numbers in the table due to rounding. True widths are estimates. Unless otherwise noted, zinc is the single largest value contributor to metal value in the zinc equivalent calculation for each intersection in this table.

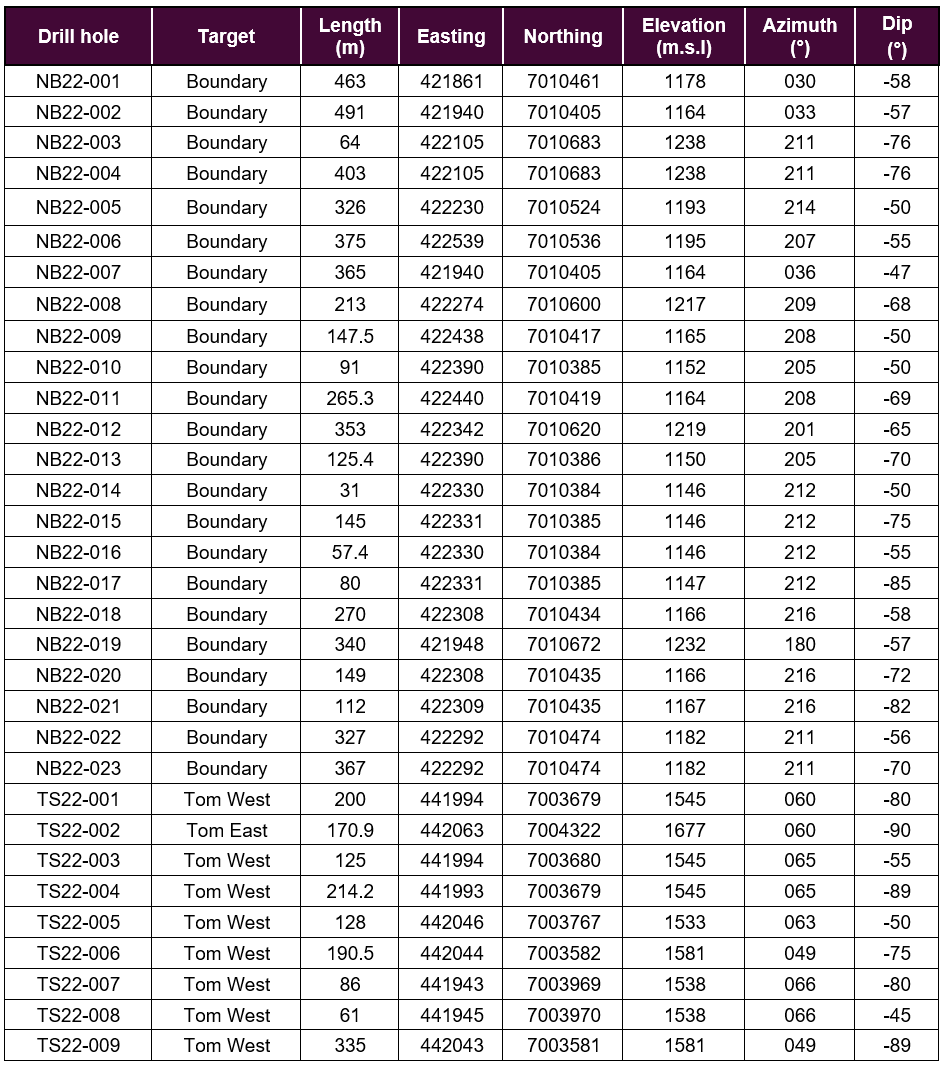

Table 3: Summary of Drill Results from 2022 Program.

All 2022 assays have now been reported for the Macmillan Pass Project. BM: Boundary Main; BW: Boundary West; TW: Tom West; TE: Tom East.

Table 4: 2022 Drill Collar Details.

Coordinate reference system: UTM Zone 9 NAD83. North reference: UTM grid north.